BVN stands for Bank Verification Number and it is an 11-digit number that is unique to each bank customer in Nigeria.

Editor's Note: This "how to check my bvn number" guide was updated on [Date].

We understand that checking your BVN can be a daunting task, but we're here to help. We've put together this comprehensive guide to help you check your BVN in a few simple steps. Whether you're a first-time user or you've forgotten your BVN, we've got you covered.

Key Differences

| Method | Requirements | Time |

|---|---|---|

| Online | BVN, Internet access | 5 minutes |

| Bank branch | BVN, ID card | 15 minutes |

| USSD | BVN, Mobile phone | 5 minutes |

Main Article Topics

- What is a BVN?

- Why is it important to check your BVN?

- How to check your BVN online

- How to check your BVN at a bank branch

- How to check your BVN using USSD

- Troubleshooting tips

How to Check My BVN Number

Your Bank Verification Number (BVN) is a unique 11-digit number that identifies you as a bank customer in Nigeria. It is important to know your BVN for a variety of reasons, including:

- Opening a bank account

- Transferring money

- Receiving payments

- Checking your account balance

- Applying for loans

- Paying bills

- Accessing government services

- Online

- At a bank branch

- Using USSD

Opening a bank account

In Nigeria, a Bank Verification Number (BVN) is a unique 11-digit number that identifies you as a bank customer. It is important to know your BVN for a variety of reasons, including opening a bank account.

- BVN is required to open a bank account in Nigeria

The Central Bank of Nigeria (CBN) requires all banks in Nigeria to collect and verify the BVN of their customers before opening a bank account. This is to help prevent fraud and money laundering.

- BVN is used to link all your bank accounts together

Once you have a BVN, it will be linked to all of your bank accounts in Nigeria. This makes it easier to manage your finances and track your transactions.

- BVN can be used to access online banking services

Many banks in Nigeria now offer online banking services. To access these services, you will need to provide your BVN.

- BVN can be used to make payments

You can use your BVN to make payments at POS terminals and online. This is a convenient and secure way to pay for goods and services.

To check your BVN, you can visit your bank branch, use the USSD code 5650#, or check online at your bank's website.

Transferring money

In Nigeria, a Bank Verification Number (BVN) is a unique 11-digit number that identifies you as a bank customer. It is important to know your BVN for a variety of reasons, including transferring money.

- BVN is required to transfer money online

Many banks in Nigeria now offer online banking services. To transfer money online, you will need to provide your BVN.

- BVN is used to verify your identity when transferring money

When you transfer money, your bank will use your BVN to verify your identity. This helps to prevent fraud and money laundering.

- BVN can be used to track your money transfers

You can use your BVN to track your money transfers. This can be helpful if you need to trace a payment or if you have any questions about a transaction.

To check your BVN, you can visit your bank branch, use the USSD code 5650#, or check online at your bank's website.

Receiving payments

In Nigeria, a Bank Verification Number (BVN) is a unique 11-digit number that identifies you as a bank customer. It is important to know your BVN for a variety of reasons, including receiving payments.

- BVN is required to receive payments from abroad

If you are expecting to receive a payment from abroad, you will need to provide your BVN to the sender. This is because the Central Bank of Nigeria (CBN) requires all banks in Nigeria to collect and verify the BVN of their customers before processing international payments.

- BVN is used to verify your identity when receiving payments

When you receive a payment, your bank will use your BVN to verify your identity. This helps to prevent fraud and money laundering.

- BVN can be used to track your payments

You can use your BVN to track your payments. This can be helpful if you need to trace a payment or if you have any questions about a transaction.

To check your BVN, you can visit your bank branch, use the USSD code 5650#, or check online at your bank's website.

Checking your account balance

In Nigeria, a Bank Verification Number (BVN) is a unique 11-digit number that identifies you as a bank customer. It is important to know your BVN for a variety of reasons, including checking your account balance.

Your BVN is linked to all of your bank accounts in Nigeria. This means that you can use your BVN to check the balance of any of your accounts, regardless of which bank you are with.

There are several ways to check your account balance using your BVN. You can:- Visit your bank branch

- Use the USSD code 5650#

- Check online at your bank's website

- Use a mobile banking app

If you do not know your BVN, you can check it by visiting your bank branch or using the USSD code 5650#. You will need to provide your bank account number and your date of birth.

Applying for loans

In Nigeria, a Bank Verification Number (BVN) is a unique 11-digit number that identifies you as a bank customer. It is important to know your BVN for a variety of reasons, including applying for loans.

Your BVN is linked to all of your bank accounts in Nigeria. This means that lenders can use your BVN to access your credit history and determine your eligibility for a loan.

Providing your BVN to a lender can also help to speed up the loan application process. Lenders can use your BVN to verify your identity and income, which can reduce the need for additional documentation.

If you are considering applying for a loan, it is important to make sure that you know your BVN. You can check your BVN by visiting your bank branch or using the USSD code 5650#.

| Benefit | How it helps |

|---|---|

| Access to credit history | Lenders can use your BVN to access your credit history and determine your eligibility for a loan. |

| Faster loan application process | Lenders can use your BVN to verify your identity and income, which can reduce the need for additional documentation. |

Paying bills

In Nigeria, a Bank Verification Number (BVN) is a unique 11-digit number that identifies you as a bank customer. It is important to know your BVN for a variety of reasons, including paying bills.

- BVN is required to pay bills online

Many companies in Nigeria now offer online bill payment services. To pay your bills online, you will need to provide your BVN.

- BVN is used to verify your identity when paying bills

When you pay a bill, your bank will use your BVN to verify your identity. This helps to prevent fraud and money laundering.

- BVN can be used to track your bill payments

You can use your BVN to track your bill payments. This can be helpful if you need to track a payment or if you have any questions about a transaction.

To check your BVN, you can visit your bank branch, use the USSD code 5650#, or check online at your bank's website.

Accessing government services

In Nigeria, a Bank Verification Number (BVN) is a unique 11-digit number that identifies you as a bank customer. It is important to know your BVN for a variety of reasons, including accessing government services.

- BVN is required to access certain government services

The Nigerian government has made it mandatory to provide your BVN when accessing certain government services. This includes services such as applying for a passport, driver's license, or voter's card.

- BVN is used to verify your identity when accessing government services

When you access government services, your BVN will be used to verify your identity. This helps to prevent fraud and identity theft.

- BVN can be used to track your government service transactions

You can use your BVN to track your government service transactions. This can be helpful if you need to track the status of an application or if you have any questions about a transaction.

To check your BVN, you can visit your bank branch, use the USSD code 5650#, or check online at your bank's website.

Online

The internet has become an essential part of our lives, and it has made it easier than ever to do a wide range of tasks, including checking our BVN number.

There are a number of ways to check your BVN number online. One way is to visit the website of your bank. Once you have logged in to your account, you should be able to see your BVN number on your account dashboard.

Another way to check your BVN number online is to use the USSD code 5650#. To do this, simply dial 5650# on your mobile phone and follow the prompts.

Checking your BVN number online is a quick and easy way to get the information you need. It is also a secure way to check your BVN number, as you do not have to share your personal information with anyone.

Here is a table summarizing the benefits of checking your BVN number online:

| Benefit | Description |

|---|---|

| Convenience | You can check your BVN number online at any time, from anywhere. |

| Speed | Checking your BVN number online is a quick and easy process. |

| Security | Checking your BVN number online is a secure way to get the information you need. |

At a bank branch

Checking your BVN number at a bank branch is a reliable and straightforward method. Here's how it works:

In-person verification: Visit your bank branch with a valid ID card, such as a national ID card or passport. The bank teller will verify your identity and provide you with your BVN.

Importance: Visiting a bank branch offers the advantage of face-to-face interaction, allowing you to clarify any doubts or queries directly with a bank representative. This can be particularly helpful for individuals unfamiliar with online or USSD methods.

Real-life example: If you need to urgently retrieve your BVN for a financial transaction but lack internet access or a mobile phone, visiting a bank branch provides a convenient and immediate solution.

Practical significance: Checking your BVN at a bank branch ensures accuracy and reliability, as the verification process involves direct interaction with a bank official. It is also a suitable option for individuals who prefer personal assistance or have concerns about the security of online methods.

Challenges: Potential challenges may include queues or waiting time during peak hours at the bank branch. Additionally, the availability of bank branches may be limited in certain areas or during weekends and public holidays.

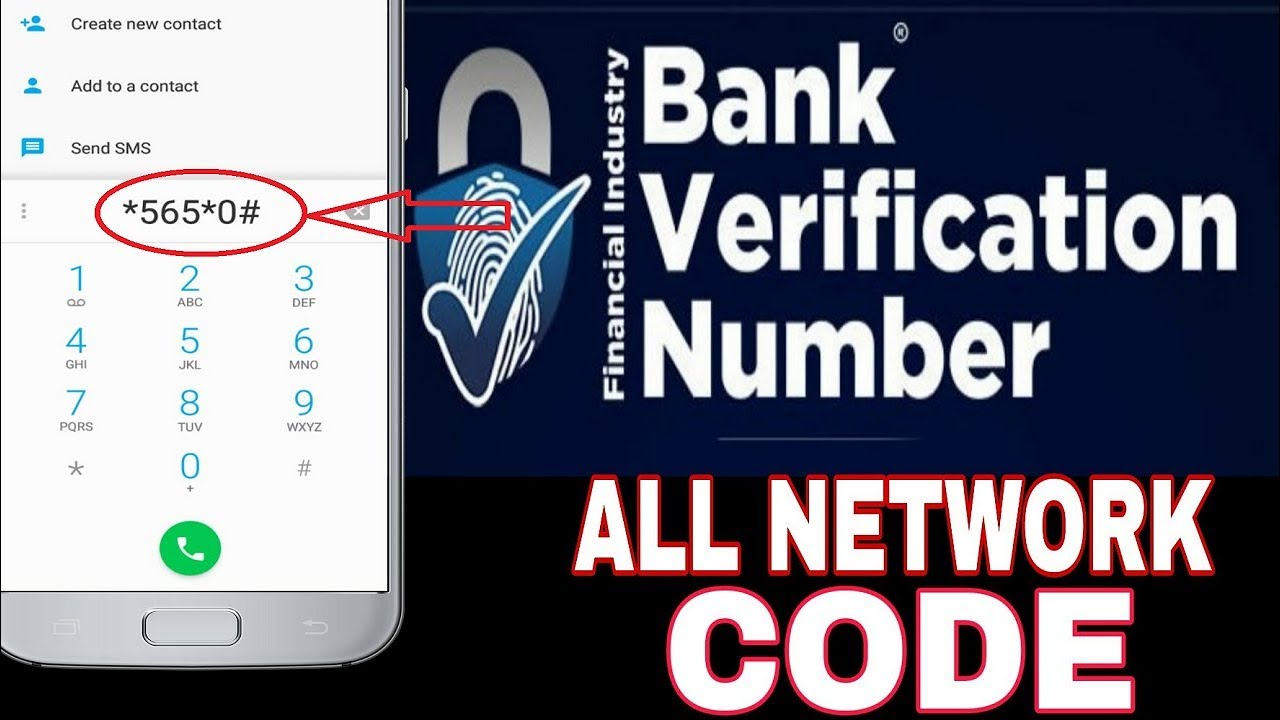

Using USSD

The Unstructured Supplementary Service Data (USSD) method offers a convenient and widely accessible way to check your BVN number in Nigeria. Here's how it works:

- Dialing the USSD code: Simply dial 5650# on your mobile phone. This code is universally applicable to all GSM networks in Nigeria.

- Response and navigation: Upon dialing the USSD code, you will receive a prompt on your phone's screen. Follow the on-screen instructions to navigate the USSD menu.

- BVN retrieval: Select the option to check your BVN. The system will then request your bank account number. Enter your 10-digit NUBAN account number and submit it.

- BVN display: Once your bank account number is verified, your BVN will be displayed on your phone's screen.

Using USSD to check your BVN is advantageous for several reasons. It is a quick and convenient method, as it can be done from any mobile phone with USSD functionality. Additionally, it does not require an internet connection, making it accessible even in areas with limited or no internet coverage.

However, it is important to note that USSD services may incur network charges depending on your mobile service provider. Therefore, it is advisable to check with your network provider for any applicable charges before using the USSD method.

FAQs on Checking BVN in Nigeria

This section addresses frequently asked questions about checking Bank Verification Numbers (BVN) in Nigeria. It aims to provide clear and concise information for individuals seeking to retrieve their BVN.

Question 1: What is a BVN and why is it important?

A Bank Verification Number (BVN) is a unique 11-digit number that identifies each bank customer in Nigeria. It is crucial for various financial transactions, such as opening bank accounts, transferring funds, and accessing government services.

Question 2: How can I check my BVN online?

To check your BVN online, visit your bank's website, log in to your account, and locate the BVN section. You can usually find your BVN displayed on your account dashboard.

Question 3: Is it possible to check my BVN using USSD?

Yes, you can check your BVN using the USSD code 5650#. Simply dial the code on your mobile phone and follow the on-screen prompts. You will need to provide your bank account number to retrieve your BVN.

Question 4: Where can I check my BVN in person?

You can visit any branch of your bank to check your BVN in person. Bring a valid ID card, such as your national ID card or passport, for verification purposes.

Question 5: What should I do if I have forgotten my BVN?

If you have forgotten your BVN, you can retrieve it by following the steps outlined above. Alternatively, you can contact your bank's customer care line for assistance.

Question 6: Are there any charges for checking my BVN?

Typically, there are no charges for checking your BVN using online or USSD methods. However, some banks may charge a small fee for checking your BVN at a branch.

Remember, keeping your BVN confidential is crucial to prevent unauthorized access to your financial accounts.

If you have any further questions or encounter any difficulties checking your BVN, do not hesitate to contact your bank for support.

Tips for Checking Your BVN in Nigeria

Verifying your Bank Verification Number (BVN) is essential for various financial transactions and accessing government services in Nigeria. Here are some informative tips to guide you through the process:

Tip 1: Choose a Convenient Method

You can check your BVN online through your bank's website or mobile app, by dialing the USSD code 5650#, or by visiting a bank branch. Select the method that best suits your needs and preferences.

Tip 2: Keep Your Details Confidential

Your BVN is a sensitive piece of information. Avoid sharing it with unauthorized individuals or websites. Only provide your BVN to trusted sources, such as your bank or authorized government agencies.

Tip 3: Verify Your Identity

When checking your BVN at a bank branch, you will be required to present a valid ID card, such as a national ID card or passport. Ensure that your ID matches the name associated with your bank account.

Tip 4: Contact Your Bank for Assistance

If you encounter any difficulties checking your BVN or have any questions, do not hesitate to contact your bank's customer support. They can provide guidance and assist you with the process.

Tip 5: Be Patient and Follow Instructions

Depending on the method you choose, checking your BVN may require following specific steps or instructions. Be patient and carefully follow the prompts to avoid errors or delays.

Remember, your BVN is an important financial identifier. By following these tips, you can ensure that you retrieve your BVN securely and efficiently whenever you need it.

Conclusion

Checking your Bank Verification Number (BVN) is a crucial aspect of financial transactions and accessing government services in Nigeria. This guide has explored various methods to check your BVN, including online, USSD, and visiting a bank branch. By following the outlined steps and adhering to the provided tips, you can retrieve your BVN securely and efficiently.

Remember, your BVN is a sensitive piece of information. Protect it from unauthorized access and only share it with trusted sources. Regularly checking your BVN helps prevent fraud and ensures the security of your financial accounts.

Unveil The Power Of Missing Someone In Heaven Quotes: Discover Comfort, Hope, And Healing

Unveiling The Influence Of Priti Patel's Husband: Discoveries And Insights

Unveiling The Cinematic Legacy Of Mary Crosby: Discoveries And Insights

How to Check BVN (Bank Vefication Number) on any Network Using USSD

How To Check BVN Number Code On Your Phone Online.

How To Check BVN Number Online Youverify